Corporate Bonds

Straight Bond

| Issue | Issue Date | Amount (millions of yen) |

Coupon Rate | Security | Maturity Date |

|---|---|---|---|---|---|

| 11th Unsecured Bond | November 1, 2018 | 10,000 | 0.524 | No | November 1, 2028 |

| 12th Unsecured Bond | July 19, 2019 | 10,000 | 0.350 | No | July 19, 2029 |

| 13th Unsecured Bond | July 13, 2020 | 20,000 | 0.240 | No | July 11, 2025 |

| 14th Unsecured Bond | July 13, 2020 | 20,000 | 0.470 | No | July 12, 2030 |

| 15th Unsecured Bond | November 27, 2020 | 20,000 | 0.030 | No | November 27, 2023 |

| 16th Unsecured Bond | November 27, 2020 | 10,000 | 0.300 | No | November 26, 2027 |

| 17th Unsecured Bond | March 15, 2023 | 20,000 | 0.290 | No | March 13, 2026 |

| 18th Unsecured Bond | March 15, 2023 | 10,000 | 0.569 | No | March 15, 2028 |

| 19th Unsecured Bond | December 14, 2023 | 20,000 | 0.847 | No | December 14, 2028 |

Ratings

| Institution Name | Rating | |

|---|---|---|

| Rating and Investment Information, Inc. (R&I) | A(Stable) | High creditworthiness supported by a few excellent factors. |

| Japan Credit Rating Agency, Ltd.(JCR) | A+(Stable) | A high level of certainty to honor the financial obligations |

For details regarding the ratings provided by each agency, please refer to the following

Rating and Investment Information, Inc. (R&I)

Japan Credit Rating Agency, Ltd.(JCR)

Rating Trend, Rating Definition

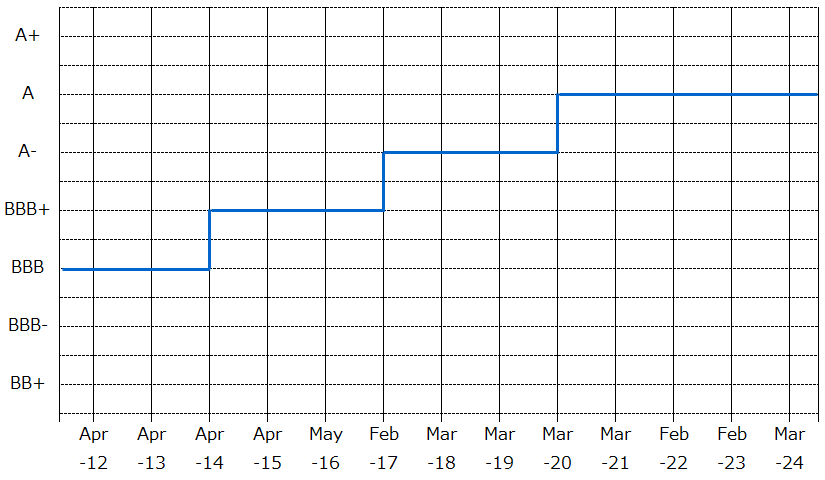

- Rating and Investment Information, Inc. (R&I)

-

Rating Trend

Rating Definition

AAA Highest creditworthiness supported by many excellent factors. AA Very high creditworthiness supported by some excellent factors. A High creditworthiness supported by a few excellent factors. BBB Creditworthiness is sufficient, though some factors require attention in times of major environmental changes. BB Creditworthiness is sufficient for the time being, though some factors require due attention in times of environmental changes. B Creditworthiness is questionable and some factors require constant attention. CCC Creditworthiness is highly questionable and a financial obligation of an issuer is likely to default. CC All of the financial obligations of an issuer are likely to default. D R&I believes that all of the financial obligations of an issuer are in default. - *A plus (+) or minus (-) sign may be appended to the categories from AA to CCC to indicate relative standing within each rating category. The plus and minus signs are part of the rating symbols.

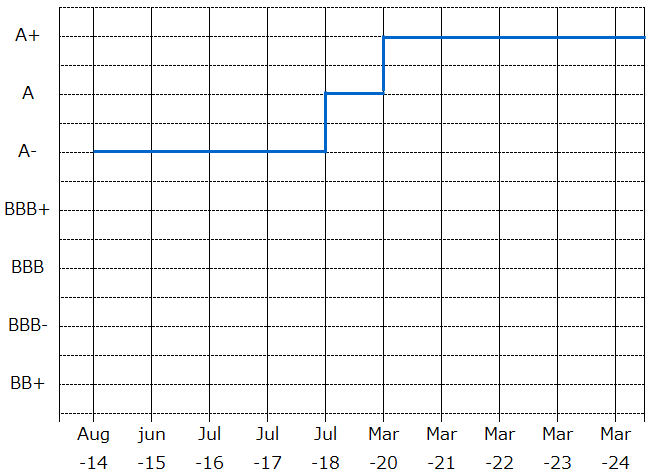

- Japan Credit Rating Agency, Ltd.(JCR)

-

Rating Trend

Rating Definition

AAA The highest level of certainty of an obligor to honor its financial obligations AA A very high level of certainty to honor the financial obligations A A high level of certainty to honor the financial obligations BBB An adequate level of certainty to honor the financial obligations. However, this certainty is more likely to diminish in the future than with the higher rating categories. BB Although the level of certainty to honor the financial obligations is not currently considered problematic, this certainty may not persist in the future. B A low level of certainty to honor the financial obligations, giving cause for concern CCC There are factors of uncertainty that the financial obligations will be honored, and there is a possibility of default. CC A high default risk C A very high default risk LD JCR judges that while an obligor does not honor part of the agreed to financial obligations, but it honors all its other agreed to financial obligations. D JCR judges that all the financial obligations are, in effect, in default. - *A plus (+) or minus (-) sign may be affixed to the rating symbols from AA to B to indicate relative standing within each of those rating scales.

- Adobe Acrobat Reader Download To view PDF documents,

you need Adobe® Reader®.Please download from here if you do not have it.