Nurturing a culture of trust

Corporate ethics and compliance with the law

As the foundation supporting the Haseko Group’s corporate activities, we work for intensive adherence to corporate governance and compliance.

Corporate Governance

Basic Approach to Corporate Governance

Haseko Corporation has made it a basic policy of its corporate management to

contribute to society and win society's confidence through its business operations

that put customers first. The Company has also positioned reinforcement of corporate

governance as one of its utmost management priorities as it recognizes that it is

indispensable to secure management transparency and objectivity for maximizing

corporate value in a stable manner over the long term and ensuring shareholders’

interests.

As part of its effort to achieve sustained growth and enhance corporate value over

the medium- to long-term, the Company has formulated its “Basic Policy on Corporate

Governance” and posted it on its website.

- Related Information

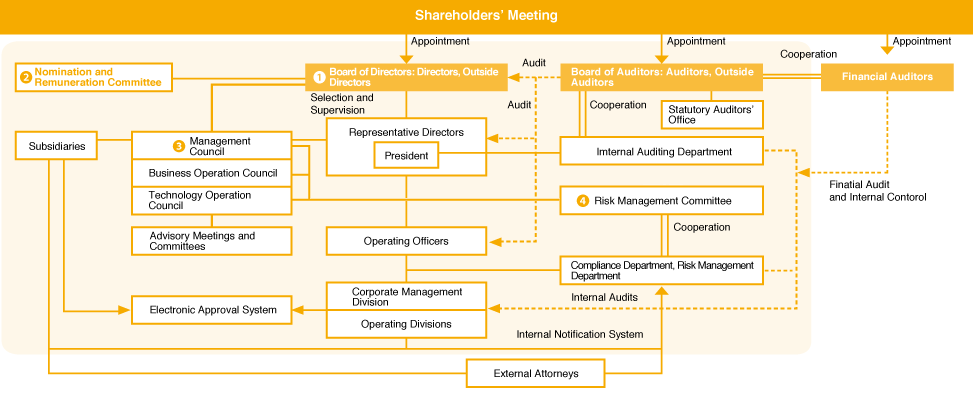

Company Institutions

Haseko Corporation has adopted an auditor system as a corporate institution. The Board of Directors of Haseko Corporation serves as the institution where directors with expert knowledge and experience in various business sectors conduct decision-making on managerial issues and supervise execution of duties of other directors. As for monitoring of management operations, the Company’s system provides the Board of Auditors, the majority of which are outside auditors, with the monitoring function from an objective and neutral standpoint from outside through implementation of audits. On top of these functions, starting in June 2016, Haseko appointed outside directors with abundant experience and track record to occupy at least one third of the Board of Directors, so that they shall provide appropriate opinions and advice in order to further activate discussions at the Board of Directors and enhance the function to monitor business management. With this system in place, we are making efforts to build an optimum system for the Company, taking into consideration the balance between the operation of the Board of Directors and the monitoring functions. In addition, the appointments of both inside directors and outside directors include a woman respectively, and we are continuing to work towards ensuring the diversity of the Board of Directors.

Decisions on certain matters authorized by the Board of Directors are made by the Management Council, Business Operation Council, and Technology Operation Council, each of which limits the participation of directors to a certain extent. In doing so, we have developed a system to separate the functions of decision-making and supervising such decision-making, so that each director can supervise the execution of duties by other directors. In addition, the Management Council is also responsible for the function of discussing in advance the important issues to be decided by the Board of Directors.

<>Note: Corporate Auditor systemThe corporate auditor system is a system stipulated under the Companies Act of Japan.

Corporate auditors are appointed at an annual meeting of shareholders, and are responsible for supervising the performance of duties by Directors. Audits comprise operational audits and accounting audits. Operational audits, also known as legality audits, are audits to examine whether Directors perform their duties in compliance with laws and regulations as well as the Articles of Incorporation. Operational audits also examine whether Directors use due care of a prudent manager in performing their duties related to management decisions as required under laws and regulations.

Accounting audits are audits to examine the financial statements and their supplementary schedules. In the case of a large company (i.e., a stock company with capital of 500 million yen or more or total liabilities of 20 billion yen or more on the balance sheet for the most recent fiscal year), the accounting auditor audits the financial statements and other related documents and submits the audit report to the Board of Corporate Auditors, and corporate auditors determine the appropriateness of the methods and results of the accounting auditor's audit.

Under the Companies Act, various measures are taken to ensure the independence of corporate auditors, such as prohibiting them from concurrently serving as Directors or employees, so that they can properly perform their duties. It also grants strong authority to corporate auditors, such as the right to demand reports from and investigate Directors and employees, and the right to demand injunctions against illegal acts by Directors.

(Source: Based on the website postings of the Japan Audit & Supervisory Board Members Association)

Diagram of company institutions and internal governance

Details of Company Institutions

- The Board of Directors holds regular meetings once a month and extraordinary meetings as necessary, and is responsible for important decision-making and regular reports on matters related to management. In addition, operating officers make reports on business operations on a regular basis to the Board.

The “Regulations of Board of Directors” stipulate that a director who has a special interest in a resolution of the Board of Directors may not participate in said resolution. Furthermore, these regulations stipulate that any business which may cause a conflict of interest between the Company and directors, including directors conducting business with competing entities, business involving the Company and directors, business involving the Company with the director acting as a third party, and any debt guarantees provided for directors, shall be subject to the approval of the Board of Directors. - The Nomination and Remuneration Committee is an advisory body for the Board of Directors, in order to secure objectivity, transparency, and fairness of the procedures related to the nomination, remuneration, etc. of directors and enhance corporate governance. The committee comprises all independent Outside Directors and an equivalent or below number of Representative Directors, etc.

- The company has established the Management Council and two operation councils - the Business Operation Council and the Technology Operation Council - to facilitate prompt and flexible decision-making on matters related to daily business operations to the extent they are authorized by the Board of Directors. Participation of directors in the Management Council and the two operation councils are limited to a certain level, so that the functions of decision-making and supervising such decision-making are divided and clarification is made for the responsibilities and authority for these functions. Moreover, the Management Council is responsible for the function of discussing in advance the important issues to be decided by the Board of Directors.

- The Risk Management Committee is held once every quarter and on an ad hoc basis as necessary whenever any material risk has arisen. It examines and determines the establishment, amendment or abolishment of internal rules on risk management and risk prevention plans, etc., and discusses and decides on the implementation policies and specific measures for risk management, among other things.

List of Directors and Corporate Auditors

For a list of Directors and Corporate Auditors, please see About HASEKO > Management Team.

For the independence criteria for outside officers, please see the appendix of Basic

Policy on Corporate Governance.

- Related Information

Training for officers

The Company has put in place an education system for Directors, Corporate Auditors,

Operating Officers, other officers and employees to provide education and training

relevant to their positions.

For Directors and Corporate Auditors, the “Basic Policy on Corporate Governance”

stipulates that “the Company will organize programs that offer seminars, etc., for

acquiring essential knowledge and information, offer and help find training

opportunities, and provide relevant financial support,” and in accordance with this

policy, the Company pays the costs of seminars and other programs in which Directors

and Corporate Auditors have participated for self-development.

For Outside Directors, the Company provides an orientation program soon after they

take office, where representatives from each department of the Company’s Corporate

Management Division and each of the other divisions as well as from Group companies

join to make presentations about businesses, operations, the Company’s current

status and major issues facing the Company. In addition, the Company also offer them

opportunities to visit the Company’s facilities and construction sites to promote

their understanding of the Company’s businesses and individual projects. For Outside

Corporate Auditors, the Company provides various reference materials about the

Company, while also inviting them to participate in some of the visits to the

Company’s facilities and construction sites, to help deepen their understanding of

the Company’s businesses.

For operating officers as well as department managers and higher-level managers, the

Company provides its “Executive Leader Development Program,” a training program that

includes, among others, a “New Managing Executive Officer Training Course,” “New

Officer Training Course,” “School of New Corporate Management,” and “Corporate

Management Course.” The Company ensures that these training courses not only cover

knowledge essential to their current positions, but also include knowledge necessary

for Directors and Corporate Auditors, with the aim of nurturing future candidates

for Director and Corporate Auditor.

Evaluation of the Effectiveness of the Board of Directors

Based on the results of analyzing and evaluating the effectiveness of the Board of Directors in fiscal 2022 in accordance with our Basic Policy on Corporate Governance, we have confirmed that the Board of Directors has held constructive and active discussions and that its effectiveness has been sufficiently ensured. The outline and results of this analysis and evaluation are as follows.

(1) Evaluation Method

We conducted a questionnaire regarding the effectiveness of the Board of Directors for all Directors and Corporate Auditors. Reflecting on the results of this questionnaire and reports from the secretariat on the operation of the Board of Directors in fiscal 2022, deliberations were held and the effectiveness of the Board of Directors as a whole was analyzed and evaluated at the Board of Directors Meeting on April 20, 2023 based on opinions presented by the Board of Auditors and individual Directors.

(2) Evaluation Items

| (i) Institutional Design/Composition | Number of members, percentage of independent Outside Directors, diversity, frequency of meetings, meeting length |

|---|---|

| (ii) Operation | Number and content of agenda items, quality and quantity of agenda materials, timing of prior distribution, quality of prior explanations |

| (iii) Deliberation | Constructive discussions and multifaceted considerations in meetings, ethos, one’s own roles and responsibilities |

| (iv) PDCA | Addressing issues raised, reporting results after resolutions, efforts toward improvement |

(3) Evaluation Results and Future Response

The questionnaire regarding the effectiveness of the Board of

Directors in fiscal 2022 and the deliberations at the Board of Directors meeting

confirmed the following details on the effectiveness of the Board of

Directors.

(i) Evaluation Results

- In fiscal 2022, the second year of the medium-term management plan, the Board of Directors held active discussions on specific business issues as well as on responding to various changes in the environment surrounding society in order to achieve the goals of the management plan.

- Active deliberations were held, including multiple discussions to decide on policies for high-risk projects.

- Multi-faceted discussions were held regarding important issues, etc., by making separate opportunities from the Board of Directors to exchange opinions.

- Reports were also made on a regular basis on future-oriented initiatives related to DX, and meaningful exchanges of opinions were conducted.

- In response to changes in the environment surrounding society, active discussions were held on CSR policy, climate change response, human rights policy, harassment, etc., in order to reach a higher level.

As a result of the above analysis and evaluation, we have confirmed

that the effectiveness of the Board of Directors has been sufficiently

ensured.

(ii) Future Response

- To further improve the effectiveness of the Board of Directors, we will strive to stimulate discussion at the Board of Directors meetings from a medium- to long-term perspective in response to the key strategies set forth in the medium-term management plan.

Executive Remuneration

(1) Matters regarding the policy for determination of

remuneration, etc. of individual Directors

(i) The way of determining the policy for determination of

remuneration of individual Directors, etc.

The basic policy for remuneration of Directors is stipulated in the Basic Policy

on Corporate Governance, which was revised by the resolution of the Board of

Directors in March 2022. In accordance with the Basic Policy on Corporate

Governance, the remuneration of Directors is determined by resolutions of the

Board of Directors based on the criteria for payment of remuneration of

Directors prepared by the President in consideration of discussions at the

Nomination and Remuneration Committee, which is comprised entirely of

independent Outside Directors as well as Representative Directors, etc.,

numbering not more than the independent Outside Directors.

(ii) Summary of the policy for determination of remuneration

of individual Directors, etc.

(a) Composition of Remuneration

・Remuneration of Directors consists of basic remuneration (fixed remuneration)

and performance-linked remuneration.

(b) Basic Remuneration

・Basic remuneration is paid monthly in a fixed amount, with a standard amount

set for each position.

・The amount of basic remuneration is determined comprehensively based on the

position, duties, and term of office of each Director and by taking into

consideration the Company’s business performance, the level of employee

salaries, and the level of remuneration of Directors at comparable

companies.

(c) Performance-Linked Remuneration

・Performance-linked remuneration consists of executive bonuses and stock

remuneration. This system makes adjustments according to business performance,

with the purpose of offering incentives for achieving business plans and

increasing corporate value.

・Because the medium-term business plan sets consolidated ordinary income as a

specific numerical target, the achievement status of the consolidated ordinary

income relative to the initial forecast as of the beginning of each fiscal year

is used as a performance-linked indicator.

・In principle, Outside Directors and Corporate Auditors are not eligible for

performance-linked remuneration.

(Formula for calculation of executive bonuses)

・Amount of bonuses = Base amount by position (fixed remuneration per month) ×

Performance coefficient (0 to 6.8)

*Bonuses are determined based on the position of each Director at the end of

the fiscal year under review and paid annually, generally after the Ordinary

General Meeting of Shareholders held in June.

(Formula for calculation of stock remuneration)

・Points to be granted = Base amount by position (fixed remuneration per month)

× Performance coefficient (0 to 2.1) / per-share BBT (Board Benefit Trust) book

value

*Points are granted based on the position of each Director at the end of the

fiscal year under review and provided annually, generally on June 1.

*The Company’s stock is delivered to Directors as stock remuneration at the

time of retirement at the rate of one stock per one point for points accumulated

by the time of retirement.

・The performance coefficient is determined based on the level of consolidated

ordinary income and a year-on-year change in consolidated ordinary income, and

for Directors serving as Executive Operating Officer or a lower rank, the

business performance of the division of which the Director is in charge is also

considered in the determination of the coefficient.

(d) Ratio of Basic Remuneration and Performance-Linked

Remuneration (Executive Bonuses and Stock Remuneration)

・While the ratio of basic remuneration to executive bonuses to stock

remuneration is basically 64:28:8, the ratio of basic remuneration to

performance-linked remuneration may vary depending on the Company’s business

performance as calculated by using a certain formula for Directors (excluding

Outside Directors).

(2) Reasons that the Board of Directors has judged that the

remuneration of individual Directors is determined in compliance with the

policy

The remuneration of individual Directors for the fiscal year under review has

been determined by the resolution of the Board of Directors based on the policy

for determination of remuneration of individual Directors, etc., stated above in

consideration of discussions at the Nomination and Remuneration Committee, which

is comprised entirely of independent Outside Directors as well as Representative

Directors, etc., numbering not more than the independent Outside Directors.

Therefore, the Company believes that it is in compliance with the said policy.

(3) Matters regarding the resolution of the general meeting of

shareholders on remuneration of Directors and Corporate Auditors,

etc.

It was resolved at the 91st Ordinary General Meeting of Shareholders held on

June 27, 2008 that the monetary remuneration of Directors shall be a maximum

amount of 700 million yen per year (provided that, of the 700 million yen, 200

million yen shall be paid as bonuses for Directors on the condition that

dividend of surplus is paid on common stock). The number of Directors was 12 at

the time of closing of the 91st Ordinary General Meeting of Shareholders. It was

also resolved at the 100th Ordinary General Meeting of Shareholder held on June

29, 2017 that, separately from the above maximum amount of monetary

remuneration, a performance-based stock compensation scheme for Directors

(excluding Outside Directors) shall be introduced as a measure to help enhance

the Company’s business performance and corporate value over the medium- to

long-term and that a maximum amount of 320 million yen shall be contributed to

the scheme for every five fiscal years. In addition, it was resolved at the

104th Ordinary General Meeting of Shareholders held on June 29, 2021, that the

scheme shall be reset with the additional condition that the maximum number of

shares to be repurchased every five fiscal years shall be 360 thousand shares.

The number of Directors (excluding Outside Directors) was 8 at the time of

closing of the 100th Ordinary General Meeting of Shareholders and 8 at the time

of closing of the 104th Ordinary General Meeting of Shareholders.

It was resolved at the 77th Ordinary General Meeting of Shareholders held on

June 29, 1994 that the monetary remuneration for Corporate Auditors shall be a

maximum amount of 100 million yen per year. The number of Corporate Auditors was

4 at the time of closing of the 77th Ordinary General Meeting of Shareholders.

(4) Total amount of remuneration, etc., of officers for fiscal

2022, etc.

This table can be scrolled

| Category | Number of eligible officers | Amount of remuneration, etc., by type | Total | |||

|---|---|---|---|---|---|---|

| Basic Remuneration | Performance-Linked Remuneration, etc. | Others | ||||

| Executive Bonuses | Stock Remuneration | |||||

| Directors (of which, Outside Directors) |

14 persons (6 persons) |

424 million yen (51 million yen) |

180 million yen (-) |

62 million yen (-) |

- (-) |

666 million yen (51 million yen) |

| Corporate Auditors (of which, Outside Corporate Auditors) |

5 persons (3 persons) |

75 million yen (25 million yen) |

- (-) |

- (-) |

- (-) |

75 million yen (25 million yen) |

| Total | 19 persons | 499 million yen | 180 million yen | 62 million yen | - | 741 million yen |

(Note) 1. The Company has introduced stock remuneration through a trust

established in accordance with the “Board Benefit Trust (BBT),” which in

principle grant the Company’s stocks to the Group’s officers at the time of

retirement. The amount of stock remuneration is an amount equivalent to the

stock remuneration expensed for the fiscal year under review based on the

scheme.

2. For the performance indicators used as a basis for calculation of the

amount or the number of performance-linked remuneration, the Company applies the

level of consolidated ordinary income for the fiscal year under review as

compared to the forecast at the beginning of the year and change in consolidated

ordinary income from the previous fiscal year as the Company has designated

consolidated ordinary income as a specific target in the medium-term management

plan.

3. The remuneration of Corporate Auditors is determined based on discussions

between the Corporate Auditors and does not exceed the maximum amount determined

by the resolution of the General Meeting of Shareholders.

Cross-Shareholdings

In the case where holding shares of our business partners will help facilitate the operation of business, Haseko’s policy is to hold shares as cross-shareholdings in accordance with the “Guidelines for Asset Acquisition in Facilitating Transactions” that is separately prescribed.

The guideline states that the total book value for assets acquired shall be about a prescribed amount of the consolidated net assets.

Haseko examines cross-shareholdings individually in terms of medium- to long-term economic rationale and future projections annually at a Board of Directors meeting, and if any shares are determined to be without merit in holding, then those shares will be reduced or otherwise reconsidered. The Board of Directors confirms the status in transactions for the businesses relevant to the cross-shareholdings once every year, including annual amounts of orders received and purchase amounts for those businesses to deliberate the feasibility of continuing shareholding.

Number of issues and amount recorded in the balance sheet (as of March 31, 2023)

This table can be scrolled

| Number of issues | Amount recorded in the balance sheet (million of yen) |

|

|---|---|---|

| Unlisted shares | 11 | 112 |

| Stock other than unlisted shares | 6 | 15,345 |

(Issue for which number of shares increased in fiscal 2022)

There are no relevant matters.

(Issue for which number of shares decreased in fiscal 2022)

There are no relevant matters.

| Number of issues | Total acquisition amount for increased shares (millions of yen) |

|

|---|---|---|

| Unlisted shares | 1 | 6 |

(Issue for which number of shares decreased in fiscal 2022)

There are no relevant matters.

Status of Audits

For the status of audits, please see the Annual Securities Report.

The periodic rotation and re-engagement of financial auditors are enacted as follows, pursuant to the presiding regulations for audit corporations in accordance with the Certified Public Accountants Act and other relevant legislation.

‧The lead engagement partner may not re-engage with the Company once he/she has exceeded a term of five consecutive accounting periods.

‧Other engagement partners may not, after having engaged with the Company for seven consecutive accounting periods, re-engage with the Company again for five consecutive accounting periods.

Annual Securities Reports (for the year ended March 31, 2023) (Japanese Only) [PDF:1,629KB]

Compliance

Basic approach and policy (Haseko Group Code of Conduct)

With the recognition that intensive compliance is indispensable for the continuity of

a corporation, the Company established the Haseko Group Code of Conduct, under

which Haseko has been working to establish a management system where all directors,

operating officers, and staff respect societal standards and take sensible courses

of action in keeping with their duties as members of society, as well as complying

with all laws and regulations both in Japan and abroad, and the Company’s articles

of incorporation, so that the Company can win the confidence of society.

The Company regularly reviews the Code of Conduct for relevancy and

effectiveness and revises it as needed.

Major points of the “Haseko Group Code of Conduct”

- Behave with common sense and responsibility / obey laws and regulations / respect human life / honor human rights / prevent risks

- Obey industry laws / observe thorough quality control / ensure complete safety management / raise customer satisfaction / obey laws such as the Antimonopoly Act / prevent unfair competition / prevent infringement upon intellectual property rights / prevent bribery and corrupt practices / make proper donations and political contributions / conduct sound accounting procedures and tax processing / disclose management information / sever ties with anti-social forces

- Develop new technology, products, and services / develop and improve products and services to fulfill customer needs / conduct environmental protection activities / contribute to society

- Management and proper use of corporate assets/management of company information/management of personal information/protection of intellectual property rights/operation of information systems

- Foster a positive workplace / comply with labor-related laws and regulations / prevent labor-related disasters and preserve the work environment / prohibit harassment / prohibit political and religious activities

- Prohibit the provision of profits related to the exercising of shareholder rights / prohibit conflict of interest / prohibit insider trading / prohibit breach of trust / prohibit any other form of fraudulent activity

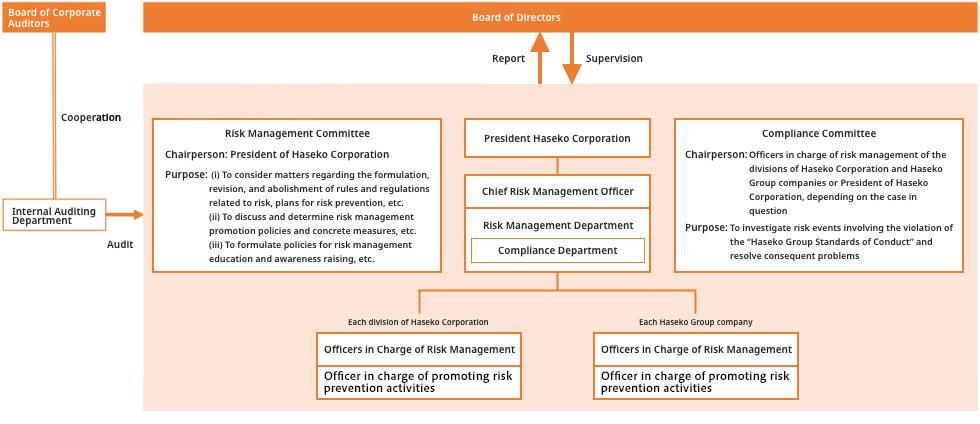

System for Promoting Compliance

The Compliance Office, established in the Risk Management Department as a department responsible for instilling the Code of Conduct across the Group and advancing compliance efforts, works to enhance the Group’s compliance.

In addition, pursuant to internal rules and regulations on internal audits, the Internal Auditing Dept., which is under the direct control of the President, investigates and evaluates whether activities of all divisions, including Group companies, conform to laws and regulations, the Articles of Incorporation, the Company's rules and regulations, corporate policies, etc. and whether they are reasonable, and works to make improvements based on the results. The frequency of audits is determined based on risks. Audits are implemented at least once every three years for major divisions and Group companies.

If there is any act violating the Code of Conduct that causes concern that it might produce a material effect, it will be reported to the President, and officers in charge of risk management will make an investigation. As needed, the Compliance Committee chaired by officers in charge of risk management or the President of the Company is convened to work to resolve it through such actions as examining circumstances, analyzing causes, identifying remedies, investigating whether there are any similar events, devising measures for preventing recurrence, and sharing the results in the Company and across the Group.

System for Promoting Compliance

Roles of the Compliance Department

(i) Address requests for consultation concerning compliance

(ii) Investigate violations by officers and employees of the Code of Conduct

and give corrective instruction

(iii) Communicate information concerning compliance

(iv) Promote education, awareness raising, etc., regarding compliance

Promotion of Compliance

1.Risk prevention efforts

To prevent compliance issues, the Company is making risk prevention efforts for risks concerning compliance, including identifying and assessing risks, formulating plans for countermeasures, and implementing risk mitigation measures, as it does for risks in other areas.

- Related Information

2. Education and awareness raising

To instill the fundamental aspects of code of conduct and compliance, all officers and employees have been provided with the “Haseko Group Compliance Book.” Information is also provided periodically online through the intranet to promote compliance, and e-learning programs are offered to all officers and employees, including contract employees and temporary employees, twice a year as an education initiative.We are also raising awareness regarding compliance by having all officers and employees consent to the Haseko Group Compliance Guideline.

Internal Whistleblowing System

The Haseko Group has set out the “Haseko Group Whistleblower Protection Rules”

pursuant to the Whistleblower Protection Act and relevant laws and regulations. In

addition, the Company has established an office in the Compliance Department of the

Risk Management Department, as well as in a law firm as an external contact,

dedicated to receiving public-interest whistleblowing reports by officers and

employees and requests for consultation regarding harassment and compliance issues

in general (including issues concerning the prevention of corruption such as graft

and bribery). The reports and requests may be filed anonymously. The Company has put in place a system for protecting whistleblowers and preserving their anonymity and created an environment where employees feel free to file a report or request consultation in order to ensure that any wrongful act or misconduct be immediately detected and corrected.

Accounts submitted to the office responsible for consultation on internal whistleblowing, and the status of subsequent responses provided, are reported to the Representative Directors, Outside Directors and Corporate Auditors on a regular basis. In November 2021, the Company introduced a training program for those in management positions at all companies in the Group, including measures for responding to cases of harassment in the workplace.

Prevention of Bribery and Corruption

The Haseko Group endeavors to ensure compliance and to prevent bribery and

corruption.

The “Haseko Group Code of Conduct” stipulate measures for preventing bribery

and corruption, and in accordance with the standards, the Company has taken actions,

such as distributing “Haseko Group Compliance Book” to all officers and employees

and offering e-learning programs.

For relationships with public employees and the like, while the Company believes that, overall, its exposure to the risk of bribery, etc., is not so high because the construction projects in which the Group is engaged are mostly private-sector projects, the Company, as part of risk prevention efforts, has implemented in high-risk departments a system in which the self-checking function autonomously works. How this checking function is working is examined in internal audits.

For relationships with business partners, the “Purchasing Business Regulations” prohibit departments involved in purchasing, which have many opportunities for negotiation, from using their status or authority within the company to seek personal benefits from business partners. Moreover, we have concluded memoranda with major business partners related to the elimination of fraudulent activity by employees of the Company and reporting via our internal whistleblowing system.

We have also taken the following measures to prevent bribery and corruption.

• The “Haseko Group Code of Conduct” stipulate that we will endeavor to engage in proper accounting and taxation treatment. Having established frameworks and procedures accordingly, we strictly ensure proper treatment.

• Having established the “Regulations on Confirmation (of Individuals) at the Time of Transactions” based on the “Act on Prevention of Transfer of Criminal Proceeds,” we thoroughly take measures such as confirmation at the time of transactions and the reporting of suspicious transactions to prevent the transfer of criminal proceeds. We also prepare “evaluation sheets on the risk of transfer of criminal proceeds” (revised as necessary) to analyze the risk of transfer of criminal proceeds based on classifications such as the products or services handled, the form of transaction, counterparty attributes, etc., and make related departments broadly aware of money laundering risks and thorough compliance with the “Act on Prevention of Transfer of Criminal Proceeds.”

We review our assessment of bribery and corruption risks each fiscal year, in the same way as for other risks, as part of the risk prevention efforts implemented by the Group. In addition to revising the content of our countermeasures as necessary based on the results of this assessment, we boost their effectiveness through confirmation as part of internal audits.

We also request that all business partners (not only suppliers but also subcontractors, agents, and others) comply with the “Haseko Group CSR Procurement Guidelines,” which include provisions such as the prohibition of bribery. In addition, we obtain signed agreements from main business partners expressing a commitment to follow these guidelines (similar agreements are obtained from new business partners when they commence transactions) and implement questionnaires on the results of self-assessment by business partners concerning their compliance with each item in the guidelines to check whether there are any issues.

Corruption-related fines and penalties

The Haseko Group was not subject to any fines or penalties for legal or regulatory violations related to corruption in fiscal 2022.

Excerpts from the Haseko Group Code of Conduct

(8) Prevention of bribery and corruption

The Company does not offer public servants or equivalent parties any unjust benefit. In addition, the Company does not offer or receive entertainment, gifts or other benefits from customers or business partners, regardless of whether directly or indirectly, beyond normal business practices and social norms in any situation of business activities.

(9) Donations and political contributions

When engaging in political contributions, donations to organizations, and similar actions, the Company shall comply with the Public Office Election Act, the Political Funds Control Act, and other relevant laws and regulations, and act in accordance with internal rules and regulations after fully considering the necessity and appropriateness of the contribution or donation.

Elimination of anti-social forces

The Company has no relations with anti-social forces or groups that threaten the

order and security of civic life, and will cope with such anti-social forces and

groups systematically, and with an adamant and resolute attitude.

The “Haseko Group Code of Conduct” also stipulate to that effect, and the

Company has distributed the “Haseko Group Compliance Book” to all officers and

employees, and has offered e-learning programs to ensure the elimination of

anti-social forces.

In addition, as part of risk prevention efforts, the Company has embedded in the

Group-wide operation flow the steps of confirming before starting a transaction that

the counterpart is not part of anti-social forces and incorporating the “anti-social

force clause” into contracts and equivalent documents, and has made these steps

mandatory.

Excerpts from the Haseko Group Code of Conduct

3. Sound and sincere business activities

(12) Rejection of relations with anti-social forces

The Company rejects any unjust demand from anti-social forces and makes no

transaction with companies relating to anti-social forces. In addition, the Company

may not use anti-social forces for any reason.

Prevention of harassment

The Haseko Group believes that preventing harassment is essential to achieving a

favorable working environment in which everyone in the workplace can demonstrate

their ability while respecting personality and values with one another.

To prevent harassment, the Company has set out “Prohibition of Harassment” under the “Haseko Group code of conduct” and its “Employment Regulations,” and has ensured to keep everyone informed thoroughly about acquisition of correct knowledge of harassment and the way how to respond to harassment if it occurs in the workplace, by sending information through the intranet, implementing e-learning education, and holding seminars, continuously.

In addition, to make the Group’s policy for harassment even clearer, the Company has established the “Haseko Group Harassment Prevention Rules” which applies to Group officers and employees, temporary employees, employees of contractors, and all who are engaged in the operation of the Haseko Group.The Company will

work to ensure the objectivity and relevancy of the Group’s measures regarding

harassment by implementing procedures for addressing harassment in the workplace

(flow for collection, review, and judgment of harassment cases) defined in the

rules.

Information security and protection of personal information

Information security

In recent years, there has been a growing risk of information assets being exposed to threats in various aspects in line with the progress of information technology.

The Haseko Group is working on the protection of information assets handled in its businesses and the enhancement of management of such assets, including customer information. We are building awareness of information management, having established the "Haseko Group’s Information Management Regulations" and "Basic Policy for Information Security" on a Group-wide scale and formulated the "Information Handling Guidelines" shared across the Group. We have also set individual management standards according to the respective businesses and contents of information handled by Group companies.

Haseko Livenet, Inc., which is engaged in the operational management of rental housing, handles personal information of residents and prospective residents as well as information assets entrusted by clients. For this reason, we have built an Information Security Management System (ISMS) in all divisions in Tokyo and Osaka. We are utilizing international standard ISO/IEC27001 in the inspection and review of day-to-day information asset management activities, having obtained certification in August 2005.

Protection of personal information

The Haseko Group recognizes the importance of protecting personal information, and has established the Privacy Policy with respect to all companies in the Group as our policy for handling personal information.

In order to clarify the structure of responsibility for the protection of personal information inside all companies in the Group, we have appointed a personal information protection manager and developed internal regulations on personal information, and are educating employees and raising their awareness so that they would comply with such regulations.

We have also established the "Guidelines for Handling Personal Information in Information Systems," which set forth the system requirements and operation rules of information systems that handle personal information, laying down the rules of the administration framework and operation method of systems that fall under the scope.

Furthermore, we execute thoroughgoing management and take various security measures to prevent the loss and leakage of personal information. We conduct internal audits periodically to verify that the series of measures to protect personal information are being implemented without fail, and take corrective action as necessary. In addition, we have undergone PrivacyMark (P-Mark) assessment to have our personal information protection status evaluated objectively by a third party, as a result of which four Group companies have been granted P-Mark.

Rules and regulations on information management

- Related information

Responsible Advertising and Publicity

Basic Approach

In accordance with the Haseko Group Code of Conduct, the Haseko Group complies with laws and regulations and internal rules, etc. in every aspect of its corporate activities and works to collect, accumulate, update and share the information on laws and regulations necessary for its operations.

System for Compliance with Laws and Regulations

The Company has put in place a system for inspecting and assessing the contents of its advertisements as needed to ensure compliance with laws and regulations.

As part of the effort to ensure compliance with the Act against Unjustifiable Premiums and Misleading Representations, the Company has set its rules for management of representations and put in place a system in which the Company appoints the person in charge of management of representations and the person in charge of safekeeping of materials for representations for each department and the person in charge of management of representations inspects a representation in advance by using a checklist to confirm that it does not infringe the Act and then grants approval. In addition, the Company holds the “Product Representations Check Meeting” as needed to inspect for appropriateness the contents of representations made by Group companies in advertisements for products, etc. that they sell.

For the Real Estate Brokerage Act, the Company holds an internal seminar every year to ensure compliance with the Act and other laws and regulations, and Group companies engaging in sales of real estate have adopted a system in which they check the contents of a representation every time they place an advertisement.

Haseko Urbest Inc. and Haseko Real Estate,Inc., which are mainly engaged in consignment sales of condominiums and real estate brokerage, respectively, regularly share any cases of inappropriate representations discovered through these checks across all departments and call attention to such issues.

Haseko Corporation’s Internal Auditing Dept. periodically confirms the status of checks by each Group company through internal audits.

Risk management

Basic approach and policy

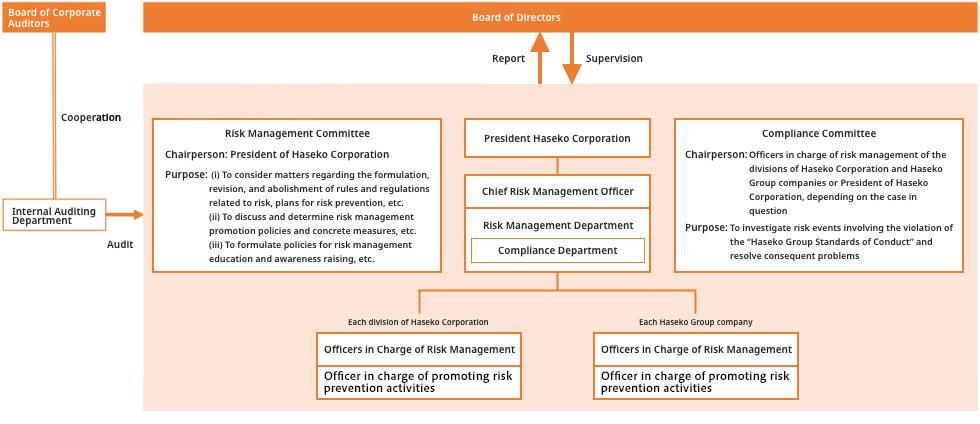

The Haseko Group has set out the “Haseko Group Risk Management Policy” with the aim of properly managing various internal and external business risks associated with its operations and continuing to maintain and enhance its corporate value. The Company has put in place its Risk Management System, and has ensured that rules and measures under the policy are known and implemented by all Haseko Group officers and employees.

Haseko Group Risk Management Policy

The Company will determine the following risk management policy and ensure that it is

implemented by all officers and employees to live up to the trust society places in

the Company.

The Risk Management Committee will develop a risk prevention plan, and based on the

plan, the Company will carry out the process from collecting and assessing risk

information and implementing improvement measures to operational auditing, with the

Risk Management Department taking a central role.

In the event of a crisis, the Company will promptly respond to it in accordance with

rules and regulations that stipulate the procedures for addressing expected crises

to minimize the impact and ensure that it will not recur.

Risk Management System

The Haseko Group has adopted a risk management system in which the President of

Haseko Corporation serves as Chief Officer to implement the “Haseko Group Risk

Management Policy.” The Company has also appointed a Chief Risk Management Officer, who is responsible for overall risk management, including risk prevention and crisis response across the Group, and officers in charge of risk management, who are responsible for leading risk management in each operating division of Haseko Corporation and the Group companies. In addition, the Company has appointed risk prevention activity promotion officers who are responsible for promoting risk prevention activity in each division of the Group.

The Company has also established the “Risk Management Committee” under the

chairmanship of the President of Haseko Corporation. The committee meets once every

quarter, while convening an extraordinary meeting as needed when a serious risk

event occurs, and works to collect, analyze, assess, and address risk events across

the Company. The results of discussions of the “Risk Management Committee” are

reported as needed to the Board of Directors, which assesses and oversees the

implementation and effectiveness of the Risk Management System.

Risk Management System

Promotion of risk prevention efforts

To prevent risk events, the Haseko Group is promoting risk prevention efforts, from

identifying and assessing risks, formulating plans for countermeasures, and

implementing risk mitigation measures, to internal auditing and reporting.

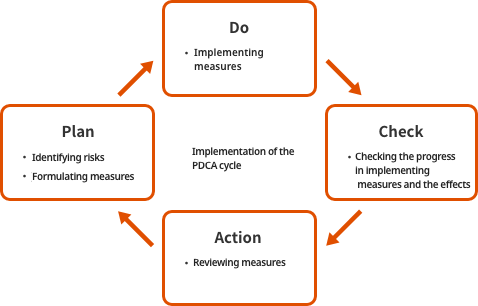

The Company seeks to continue to improve and raise its performance by using the PDCA

cycle in these risk prevention efforts.

Plan: Identifying new risks, formulating measures for new risks, and reviewing

measures for existing risks

Do: Implementing measures

Check: Checking (progress in implementing measures and the effects, etc.) via

internal auditing, etc.

Action: Reviewing measures and making revisions, etc., as needed

Business Continuity Plan (BCP)

The Haseko Group has formulated a “Business Continuity Plan” with the aim of

establishing a mechanism of clarifying operations of Group companies in the event of

a major earthquake and other natural disasters, ensuring the safety of “housing”

provided by us, preventing the suspension of operations or in the event that they

are suspended, enabling the resumption of operations within the shortest possible

time, as well as promptly preserving offices and tasks after ensuring the safety of

employees and their families, enabling employees engaged in restoration activities

and restoration support to take action autonomously.

The “Business Continuity Plan” stipulates that it shall be triggered by the authority of the head of Group Control Headquarters in the event where large earthquakes with a seismic intensity of upper 5 are observed at an earthquake observation point of the Japan Meteorological Agency at the Haseko Group’s business bases (earthquakes below the reference seismic intensity are not excluded depending on the degree of the damage, etc.), and also in the event of natural disasters other than earthquakes (including storms, heavy rain, heavy snow, floods, high tides, tsunamis, eruptions, etc.) if the damage is significant. In the event of an emergency, the Company will set up a Group Control

Headquarters and a Group Control and Support Headquarters in Tokyo or Osaka and a

Regional Control Headquarters in the Tokai and Kyushu areas, while each Group

company will set up a control headquarters.

BCP drill for natural disaster response

To ensure that the “Business Continuity Plan” will be promptly and properly

implemented in the event of a natural disaster, the Company has made it a policy

to hold a BCP drill once or more every year.

For the drill held in fiscal 2022, the Company set a hypothetical scenario in

which an earthquake with a seismic intensity of upper 6 occurred during

non-business hours (on a holiday or at night), which brought public

transportation systems to a halt and caused devastating damage to the areas

where the Company’s head office and offices are located, so that the Company’s

staff had difficulty coming to the offices. The Company has put in place a

system in which the staff of the natural disaster response task force will be

able to set up a headquarters on the web by Teams and more promptly grasp the

situation and take the initial response by utilizing mobile devices

(smartphones, mobile PCs, etc.).

In addition, with the possibility of a communications failure in mind, we laid out the standards for action corresponding to the respective roles of all officers and employees during and outside business hours, and have made these known to the Group’s officers and employees.

- Program for the BCP drill

- (i) Drill for setting up the Natural Disaster Response Task

Force (by Teams)

(ii) Drill for checking the situations of employees’ safety

Reporting from employees on the situations of their safety, confirmation by each headquarters, etc.

(iii) Drill for an initial check of the situations of damage to properties from the disaster

Initial check of the Company’s offices, offices at construction sites, properties relating to the Group, etc. by using a map application software

(iv) Drill for real-time reporting on the situations of damage from the disaster

Sharing images of sites of disaster with headquarters by using Teams

(v) Drill for setting support headquarters

Setting Group Control and Support Headquarters in Tokyo and Osaka, collecting and summarizing information, etc.

(vi) Drill for requesting the dispatch of technical staff

Requesting the dispatch of technical staff to properties relating to the Group for emergency restoration

(vii) Drill for staff going to the office on foot

Checking the situations of damage from the disaster in the Company’s offices in the event that public transportation systems cannot be used

(viii) Training for technical and community support staff

Checking the buildings of elderly care centers managed by Group companies and providing support for the evacuation of residents of the centers (This drill was not performed in fiscal 2021 due to the COVID-19 pandemic.)

- Sustainability TOP

- Message from the Management

- Haseko Group's Sustainability Management

- D&I at the Haseko Group

- Climate Change Response

- Creating attractive living spaces

- Building a company worth working at

- Protecting the precious environment

- Nurturing a culture of trust

- ESG Data and Disclosures

- Integrated Report

- Philosophy and Policies

- Special feature archives