Nurturing a culture of trust

Corporate Governance

Basic Approach to Corporate Governance

Haseko Corporation has made it a basic policy of its corporate management to contribute to society and win society's confidence through its business operations that put customers first. The Company has also positioned reinforcement of corporate governance as one of its utmost management priorities as it recognizes that it is indispensable to secure management transparency and objectivity for maximizing corporate value in a stable manner over the long term and ensuring shareholders’ interests.

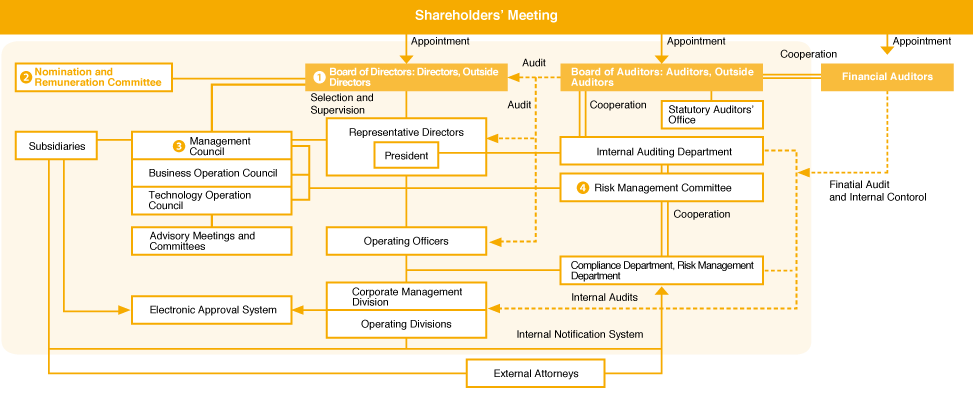

Basic Explanation of Company Institutions

Haseko Corporation has adopted an auditor system as a corporate institution. The Board of Directors of Haseko Corporation serves as the institution where directors with expert knowledge and experience in various business sectors conduct decision-making on managerial issues and supervise execution of duties of other directors. As for monitoring of management operations, the Company’s system provides the Board of Auditors, the majority of which are outside auditors, with the monitoring function from an objective and neutral standpoint from outside through implementation of audits. On top of these functions, starting in June 2016, Haseko appointed outside directors with abundant experience and track record to occupy at least one third of the Board of Directors, so that they shall provide appropriate opinions and advice in order to further activate discussions at the Board of Directors and enhance the function to monitor business management. With this system in place, we are making efforts to build an optimum system for the Company, taking into consideration the balance between the operation of the Board of Directors and the monitoring functions. In addition, one of the appointed outside directors is a woman, and we are continuing to work towards ensuring the diversity of the Board of Directors.

Decisions on certain matters authorized by the Board of Directors are made by the Management Council, Business Operation Council, and Technology Operation Council, each of which limits the participation of directors to a certain extent. In doing so, we have developed a system to separate the functions of decision-making and supervising such decision-making, so that each director can supervise the execution of duties by other directors. In addition, the Management Council is also responsible for the function of discussing in advance the important issues to be decided by the Board of Directors.

Details of Company Institutions

- The Board of Directors holds regular meetings once a month and extraordinary meetings as necessary, and is responsible for important decision-making and regular reports on matters related to management. In addition, operating officers make reports on business operations on a regular basis to the Board.

- The Nomination and Remuneration Committee is an advisory body for the Board of Directors, in order to secure objectivity, transparency, and fairness of the procedures related to the nomination, remuneration, etc. of directors and enhance corporate governance. The committee comprises all independent Outside Directors and an equivalent or below number of Representative Directors, etc.

- The company has established the Management Council and two operation councils - the Business Operation Council and the Technology Operation Council - to facilitate prompt and flexible decision-making on matters related to daily business operations to the extent they are authorized by the Board of Directors. Participation of directors in the Management Council and the two operation councils are limited to a certain level, so that the functions of decision-making and supervising such decision-making are divided and clarification is made for the responsibilities and authority for these functions. Moreover, the Management Council is responsible for the function of discussing in advance the important issues to be decided by the Board of Directors.

- The Risk Management Committee is held once every quarter and on an ad hoc basis as necessary whenever any material risk has arisen. It examines and determines the establishment, amendment or abolishment of internal rules on risk management and risk prevention plans, etc., and discusses and decides on the implementation policies and specific measures for risk management, among other things.

Effectiveness Analysis and Evaluation of the Board of Directors

Based on the results of analyzing and evaluating the effectiveness of the Board of Directors in fiscal 2018 in accordance with our Basic Policy on Corporate Governance, we have confirmed that the Board of Directors has held constructive and active discussions and that its effectiveness has been sufficiently ensured. The outline and results of this analysis and evaluation are as follows.

Evaluation Method

We conducted a questionnaire regarding the effectiveness of the Board of Directors for all directors and auditors. Reflecting on the results of this questionnaire and reports from the secretariat on the operation of the Board of Directors in fiscal 2018, deliberations were held and the effectiveness of the Board of Directors as a whole was analyzed and evaluated at a meeting of the Board of Directors held in April 2019, based on opinions presented by the Board of Auditors and individual directors.

Evaluation Items

- Institutional Design/Composition: Number of members, percentage of independent Outside Directors, diversity, frequency of meetings, meeting length

- Operation: Number and content of agenda items, quality and quantity of agenda materials, timing of prior distribution, quality of prior explanations

- Deliberation: Constructive discussions and multifaceted considerations in meetings, ethos, one’s own roles and responsibilities

- PDCA: Addressing issues raised, reporting results after resolutions, efforts toward improvement

Evaluation Results and Future Response

As a result of analysis and evaluation, we confirmed that the effectiveness of the Board of Directors in fiscal 2018 was adequately ensured, and that we will work to improve a few issues recognized in the evaluation results.

Going forward, we will continue utilizing effectiveness analysis and evaluation of the Board of Directors to further improve the Board of Directors, and make efforts to enhance its effectiveness.

Executive Remuneration Determination Process

Remuneration of directors is determined by resolutions of the Board of Directors based on our Basic Policy on Corporate Governance, following discussions in the Nomination and Remuneration Committee, which comprises all independent Outside Directors and the same or lower number of Representative Directors, etc. Remuneration of auditors is determined by discussions among the auditors. The Nomination and Remuneration Committee held one meeting in the current fiscal year, where it discussed the basic remuneration for directors and reconfirmed the basic remuneration table for directors. The committee also discussed the application of performance factors based on the calculation formula for the performance-linked remuneration and the achievement status of performance indicators, and unanimously approved a proposal drafted for the Board of Directors.

Outline of Directors’ Remuneration System

Composition of Remuneration

- Remuneration of directors consists of basic remuneration (fixed remuneration) and performance-linked remuneration.

Basic Remuneration

- Basic remuneration is paid monthly in a fixed amount, with a standard amount set for each position.

Performance-Linked Remuneration

- Performance-linked remuneration consists of executive bonuses and stock remuneration. This system makes adjustments according to business performance, with the purpose of offering incentives for achieving management plans and increasing corporate value.

- Because the medium-term management plan sets consolidated ordinary income as a specific numerical target, the achievement status of the consolidated ordinary income relative to the initial forecast as of the beginning of each fiscal year is used as a performance-linked indicator.

- In principle, Outside Directors and Auditors are not eligible for performance-linked remuneration.

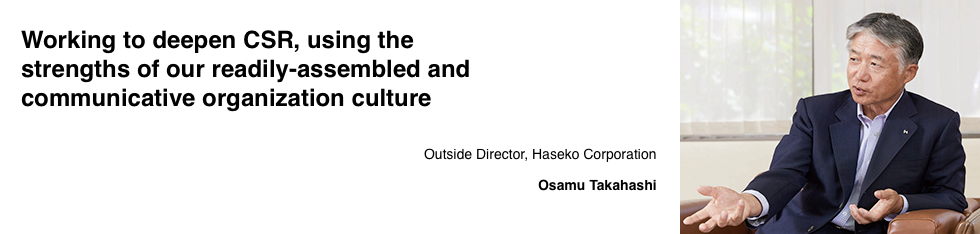

Interview with an Outside Director

Q. Please give us your impression, having participated in management as an Outside Director, and your opinions on the changes that have occurred in the Group in the 3 years since you assumed office.

I participated in drafting and formulating the plan before the start of the NBj* three-year plan. The first thing I felt was that a culture of accepting diverse opinions is deeply rooted in the entire Group, including the Board of Directors.

In fiscal 2017, the first year of the plan, and again in fiscal 2018, we reached ordinary income of 100 billion yen. I believe that this success was earned by our strategy of taking on various new challenges that will lead to future growth, in addition to focusing on steady accumulation, centered on core businesses such as for-sale condominium design and construction, management, and rental through active discussion.

As for changes within the Group that will lead to taking on new endeavors, we have grouped affiliated companies under three holding companies based on “deepening coordination among the Group companies,” which is one of the basic policies of the Plan, and we have also promoted a cross-sectional ICT plan within the Group. Furthermore, we established the Value, technology and innovation division, which is responsible for creating new business models and conducting verification experiments using digital technology. The Value, technology and innovation division has realized cutting-edge office environments utilizing the free address system and paperless work, which completely overturn the image of the conventional construction industry. I have great expectations for future developments, as it will lead to business reforms based on a medium- to long-term perspective.

*NBj: Refers to the “newborn HASEKO Jump Up Plan” being promoted as the final three years (from the fiscal year ended March 31, 2018 to the fiscal year ending March 31, 2020) of the six-year management plan.

Q. How would you evaluate the corporate governance structure and CSR initiatives?

There are three major elements premising the establishment of a governance structure: the reason for a company’s existence (management philosophy), the form it aims to achieve (vision), and the action plan to achieve this. This “framework” has already been established, and we are also developing a structure based on Japan’s Corporate Governance Code of the TSE, such as increasing the number of Outside Directors to five.

Issues we face in the future include how to achieve sustainable growth and improve corporate value. How we can balance profit distribution and invest in growth strategies, so as to emphasize ROE (return on equity) as an indicator that exceeds the cost of capital and maintain and improve the level of ROE. I believe that we need to conduct careful discussion, including how the company is organized.

With regard to CSR, I think we took a new step by formulating a vision and action policy in fiscal 2017, establishing a “CSR Action Plan” that includes thorough compliance awareness and guidelines for SDGs in fiscal 2018. However, CSR initiatives do not end once the system is in place. I would like our company to make the entire organization aware of this, and work towards continuous promotion of activities, such as holding regular forums for discussion among all employees to raise awareness, with the aim of fulfilling our social responsibilities as one party responsible for creating a healthy society.

Q. What are your expectations and opinions for the future of the Haseko Group?

For over 80 years since our company was founded, we have sincerely worked to provide manufacturing and services from both the perspectives of technology and sales, in order to realize the ideal living environments for people and urban areas. This attitude is the DNA of our company, and I hope for all employees to carry it on in the future. I think that our openness, such as the opportunity for executives to speak directly with employees through monthly morning meetings, is another strength of ours that contributes to a highly transparent management system and a culture of attempting new endeavors. In addition, I expect our company to further implement the active promotion of female managers in order to strengthen services from the perspective of consumers.

In the future, it will be of utmost importance for us to support the emergence of new demand, in place of conventional suburban and large-scale condominiums, as we face significant social changes such as the declining birth rate, aging society, shrinking population, and compaction of urban space.

Our company has a unique position in the industry, as we have specialized in the creation of housing and lifestyles. I think that accumulation of this specialization will augment our project planning and construction in fields other than non-housing and for-sale condominiums expected to expand in the future, such as high convenience urban development that combines commercial facilities, nursery schools, and nursing care facilities. I expect that we will further refine our current technologies and link these with AI, IoT, and robots to realize value other companies cannot imitate, by utilizing our characteristics. I myself will also strive to make a greater contribution as an Outside Director.

-

- Creating attractive living spaces

-

- Providing housing tailored to diverse lifestyles

- Utilizing ICT and promoting open innovation

- Supporting interaction in local communities

- Regeneration condominiums and improving the value of housing (rebuilding, prolonging life and renovation)

- Quality management system

- Realizing safe, secure and comfortable spaces

- Developing technologies that support daily life

- Services to help bring greater peace of mind and comfort in daily life

- Contributing to the solution of social issues in housing

-

-

- Protecting the precious environment

-

- Developing the lineup of ZEH Condominiums

- Environmental management system

- Flow of materials

- Construction: Initiatives to prevent global warming

- Construction: Cyclical resource use and waste reduction initiatives

- Water resources

- Designing: Environment-conscious initiatives

- Research and technological development: Technology to realize reduction of environmental burden

- Social evaluation of environmental preservation activities

- Offices: CO2 reduction and energy-saving activities

- Environmental accounting

-

- Nurturing a culture of trust

-

- Corporate Governance

- Compliance/risk management system

- Information security and protection of personal information

- Respect of human rights

- Biodiversity conservation activities

- Next-generation development support

- Activities to protect the regional environment

- Helping resolve regional issues

- Social welfare activities

- Philanthropic activities

- Donation and sponsorship